Owner's Representative Services

Hone Strategic provides consulting services for owners of historic buildings looking to substantially rehabilitate their properties. Hone Strategic has a holistic approach to the design and construction process. We provide comprehensive project development services, from pre-development planning through certificate of occupancy using Federal and State Historic Rehabilitation Tax Credits.

Qualified costs on projects can be credited up to 45%. Contact us to find out how your project qualifies.

DOCUMENT

Documentation is the first step to a successful historic rehabilitation project and involves careful attention to detail. Whether for one building or an entire district, surveys can be an excellent pro-active planning tool. They help prioritize landmark designation and funding, apply for grants, and identify areas where historic preservation and community revitalization can be combined. Hone Strategic offers:

- Historic Property Research

- Historic Structure Reports

- National Register Nominations

- Local Landmark Nominations

- Historic Resource Surveys

DESIGN

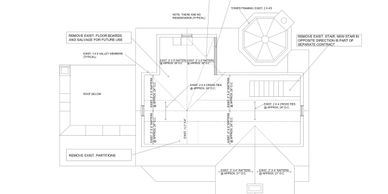

Design review for historic structures and districts is one of the most complex aspect of project approvals. Hone Strategic provides guidance for design solutions that comply with the Secretary of the Interior's Standards that can also meet design needs of a complete repurposing of a building's use. Services include:

- Review of construction plans for tax credit compliance

- Act as liaison between architects, engineers, contractors, the State Historic Preservation Office, and the National Park Service

- Procurement of permits and presentation of project to municipal boards and committees (e.g., architectural review, landmarks, historic districts, planning, zoning)

DEVELOP

Hone Strategic provides consulting services for developers or property owners seeking historic tax credits for rehabilitation of historic properties. We assist in the completion of the three-part Federal and New York State tax credit applications. Available tax credits include:

- Federal Rehabilitation Tax Credit (20% Available)

- New York State Historic Homeownership Rehabilitation Tax Credit (20% Available)

- New York State Historic Commercial Properties Tax Credit (20% available)

- New York State Historic Barns Tax Credit (25% Available)

Copyright © 2017 Hone Strategic LLC - All Rights Reserved.

Powered by GoDaddy Website Builder